As revenue agencies move towards OECD tax administration 3.0 concepts, they will shift from providing retail services primarily to taxpayers and tax agents to providing wholesale services to Digital Service Providers (DSPs) who will deliver these experiences within natural business systems.

Many revenue agencies are already on this digitalisation journey and recognise DSPs as valued delivery partners. However, it may not be clear what this shift looks like across the tax ecosystem.

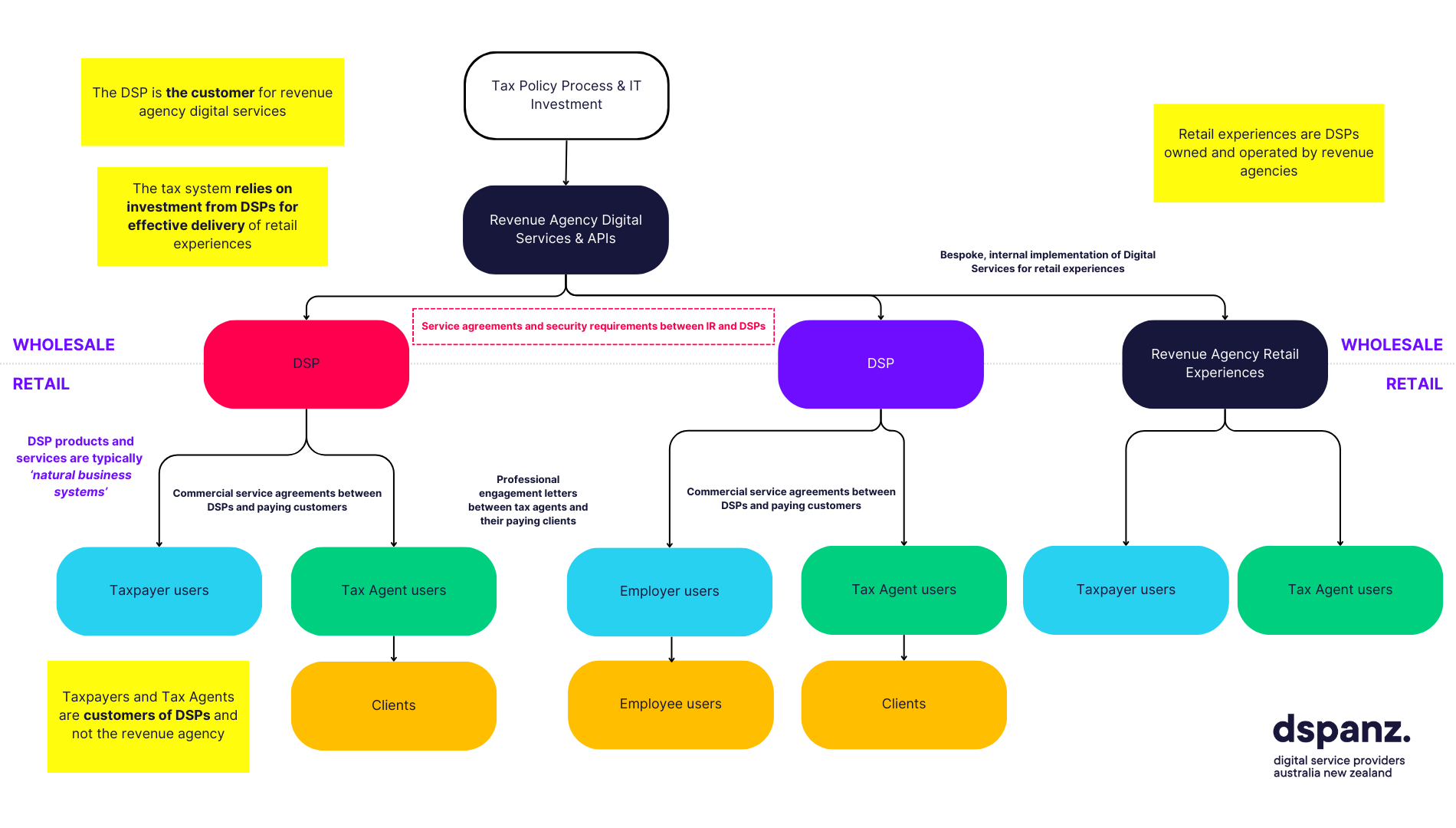

DSPANZ has created the below diagram illustrating how DSPs and revenue agencies will provide wholesale and retail services across this ecosystem in a world where tax and business processes just happen.

We encourage DSPs and others to utilise this diagram, but please note that it is available under Attribution 4.0 International.

Continue reading for a detailed explanation of the diagram.

Wholesale services

The top half of the diagram demonstrates that revenue agencies provide wholesale services to DSPs while acknowledging factors that influence and impact revenue agencies and DSPs.

Most revenue agencies will make digital services, such as Application Programming Interfaces (APIs), available to DSPs through "gateways". Security requirements and service agreements are often in place around these gateways to protect DSPs and revenue agencies.

Before any digital services are made available to DSPs and their customers, overarching policy and investment processes will determine the following:

- What can be delivered

- How it will be delivered

- When it will be delivered.

During decision-making processes, consultation between revenue agencies and DSPs is integral to ensuring that services meet the needs

of both parties and that any DSP delivery deadlines allow enough time for implementation and transitioning customers.

Retail services

The lower half of the diagram depicts where retail services are provided in the tax ecosystem - in natural business systems. This section explicitly demonstrates that end users - taxpayers and tax agents - are customers of DSPs, not revenue agencies.

Revenue agencies rely on DSPs as the delivery arm for new experiences or policy changes, and the tax ecosystem ultimately relies on investments from DSPs to effectively deliver retail experiences. Here, it's worth reiterating that consultation with DSPs during decision-making is critical.

DSPs will have agreements with paying customers, such as terms of use and service agreements, similar to those of revenue agencies.

It is worth noting that revenue agencies often operate their own retail experiences for taxpayers and tax agents.

So, in summary...

The shift from retail to wholesale services in the tax ecosystem represents a fundamental transformation towards more efficient and effective tax administration. By leveraging the capabilities of DSPs, revenue agencies can deliver innovative and seamless tax experiences to end users, ultimately enhancing compliance and reducing the administrative burden for taxpayers and tax agents.